health insurance for cats made practical

I cut through the noise and land on what matters: predictable costs, reliable claims, and clear limits. No drama, just coverage that works when your cat needs care.

What it usually covers (and what it often doesn't)

Most accident-and-illness plans aim to soften the blow of high, sudden bills. Details vary, but the backbone is consistent.

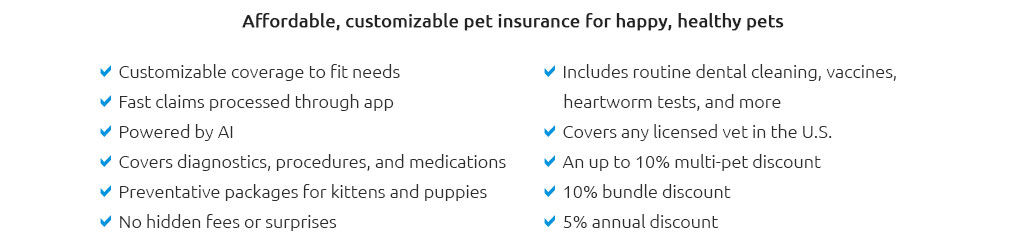

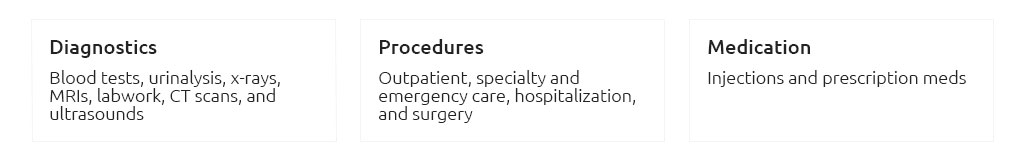

- Covered more often than not: accidents, toxins, diagnostics (bloodwork, X-rays, ultrasounds), prescription meds, surgery, hospitalization, cancer treatment, and sometimes dental injury.

- Sometimes covered: congenital or hereditary issues after waiting periods, orthopedic problems (with exam notes), rehab or acupuncture when prescribed.

- Usually not covered: pre-existing conditions, routine wellness unless you add it, breeding costs, cosmetic procedures, behavioral training without a veterinary diagnosis.

How the money flows

You pay a monthly premium. When something happens, you visit any licensed vet, pay the bill, and file a claim. Insurer reimburses a percentage after your deductible. Simple on paper; the nuance is in the numbers.

- Deductible: annual or per-condition. Higher deductible lowers the premium.

- Reimbursement rate: commonly 70% - 90% of eligible costs after the deductible.

- Annual limit: from $5k to unlimited. Higher limits increase premiums.

- Waiting periods: typically 2 - 15 days for accidents, longer for illnesses/orthopedic issues.

Costs you can bank on (with measured uncertainty)

I expect accident-and-illness coverage for an adult indoor cat to land roughly between $15 - $35 per month, rising with age and richer benefits. I can't promise your rate matches that - zip codes and underwriting shift - but the range holds steady across most quotes I review.

- Ways to steady your bill: pick an annual deductible you can actually meet; choose 80% reimbursement as a sensible middle; avoid unnecessary add-ons.

- Where costs creep: older enrollments, prior issues flagged as pre-existing, and low deductibles paired with high limits.

Key terms I won't gloss over

- Pre-existing condition: any sign or symptom before enrollment or during waiting periods. Expect strict definitions.

- Bilateral conditions: if one knee is diagnosed before coverage, the other knee may be excluded. Read that clause twice.

- Reasonable and customary: reimbursements may be capped to typical local fees, not the highest bill in town.

- Exam requirements: many plans need a recent vet exam to activate orthopedic coverage.

Real-world moment

Last spring, my cat swallowed ribbon. ER visit. Radiographs. Overnight observation. I uploaded the itemized invoice through the app in the parking lot and, after my deductible, 80% hit my bank within five days. Not glamorous, just dependable.

What I evaluate first

- Claim speed and transparency: average payout time, clear status tracking, and reasons for any adjustments.

- Coverage stability: minimal history of abrupt policy changes or sharp annual increases beyond normal age-based adjustments.

- Underwriting strength: who backs the policy and how long they've been in the pet segment.

- Customer support: human help on weekends, and guidance on complex claims.

Red flags worth pausing on

- Short-term "intro" rates with vague renewal rules.

- Many exclusions tucked into glossary terms.

- Per-incident limits paired with low annual caps.

- Clunky claim submission that still demands mailed paperwork.

Setting expectations before you enroll

Insurance won't make routine care free; it's there to keep emergencies from wrecking savings. You'll still budget for preventive visits. You'll still read fine print. But coverage should remove the fear of saying yes to needed treatment.

My streamlined decision path

- Lock in an annual deductible you're comfortable paying once per year.

- Choose 80% reimbursement with a mid-to-high annual limit (or unlimited if you want fewer what-ifs).

- Confirm how pre-existing conditions and bilateral issues are handled in writing.

- Skim two sample policies; note waiting periods and any exam requirements.

- Enroll while your cat is healthy - pricing and eligibility tend to be kinder.

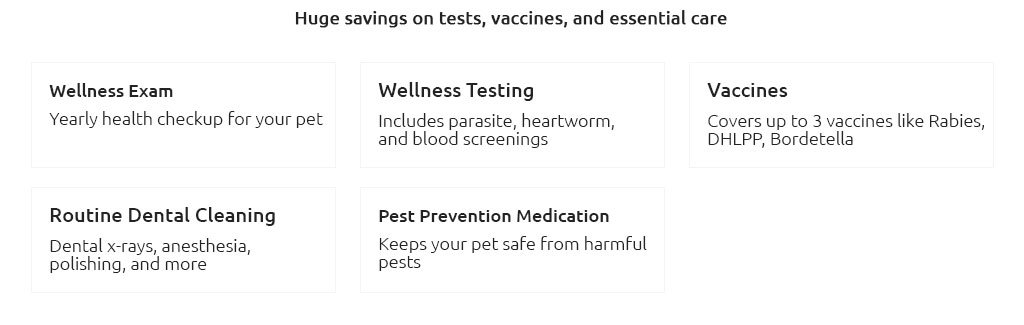

Wellness add-ons: maybe

If you prefer predictable monthly outlays, wellness riders can make sense, but they rarely "beat" paying cash. I'm fine skipping them unless the math clearly nets out or you value the budgeting comfort.

Bottom line I'm comfortable standing behind

Pick solid fundamentals over fancy extras. A clear policy, steady claims, and responsive support will outperform a flashy brochure. With health insurance for cats dialed in, you avoid decision panic and move straight to care - calmly and on time.